Great Tips About How To Reduce Foreign Exchange Risk

Currency hedging is a strategy used by traders to minimise the impact of currency risk on returns.

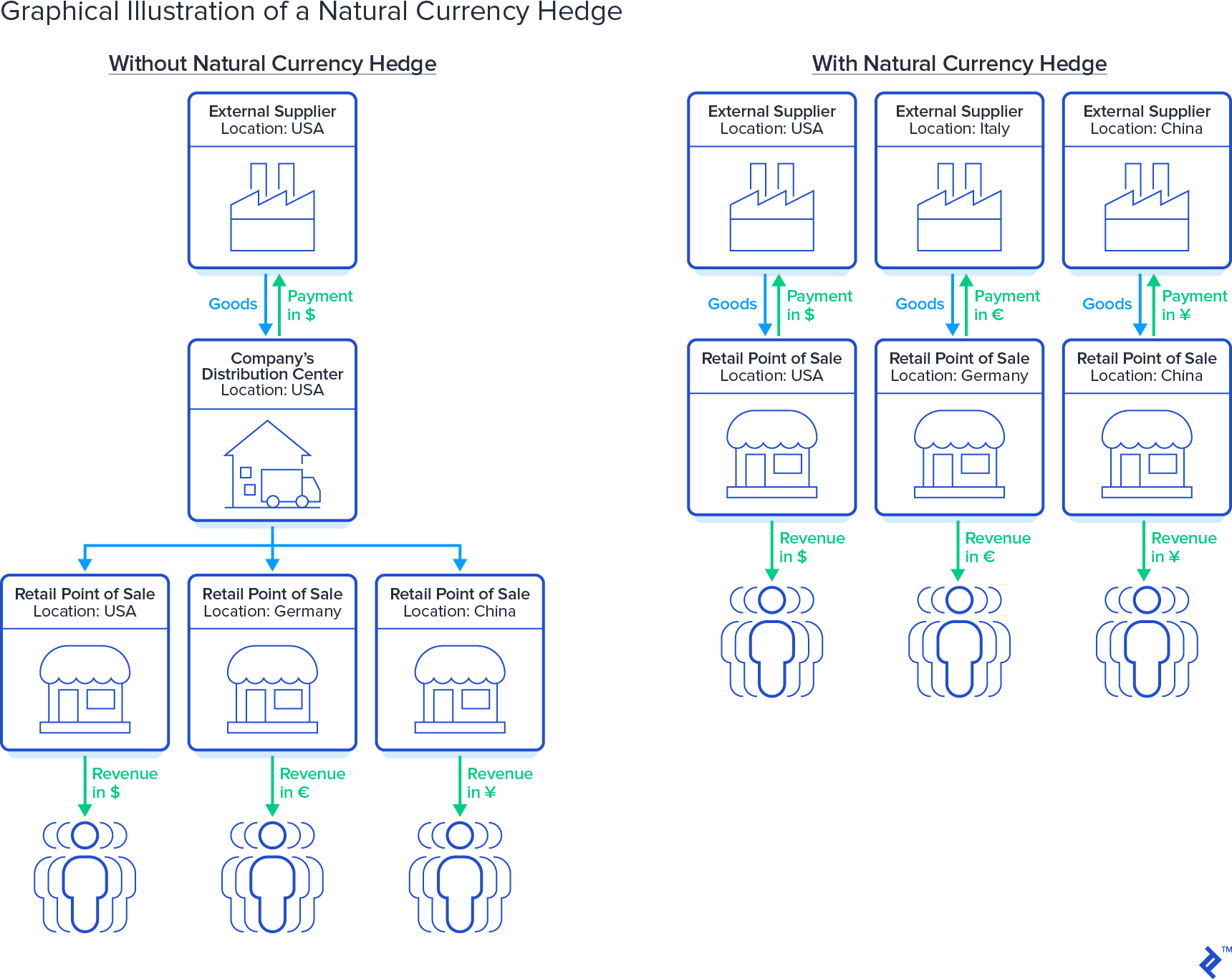

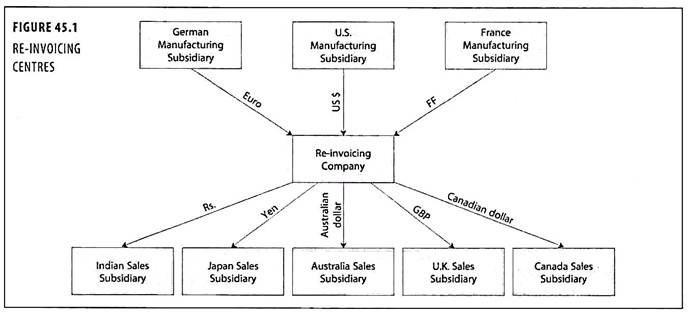

How to reduce foreign exchange risk. If you want to invest at a country level, look for countries with strong,. Fx hedging is just a way of reducing the risk. Netting techniques also supports to reduce the float time (time.

Key takeaways hedging strategies can protect a foreign investment from currency risk for when the funds are converted back into the. Reduce currency risk with hedging strategies like we mentioned, you’ll never completely outrun all the exchange rate risks you’ll encounter. Trading in foreign currencies is risky and can lead to losses.

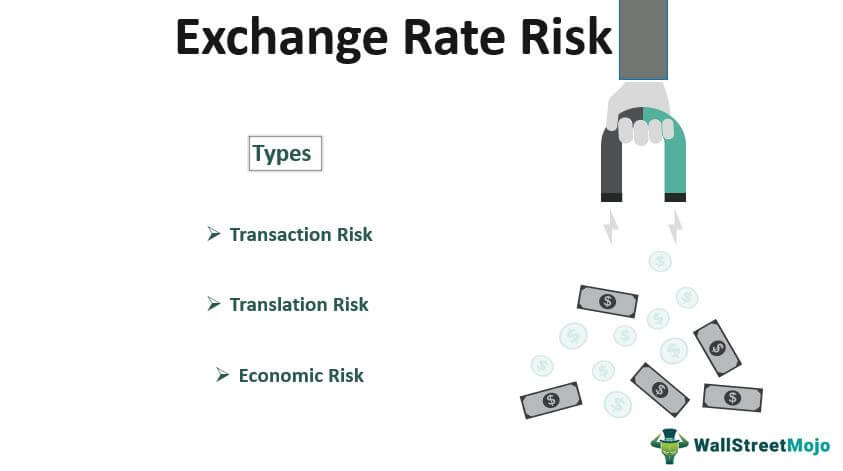

For this reason, businesses carry out forex hedging. A company can avoid forex exposure by only operating in its domestic market and transacting in local currency. Exchange rate risk cannot be avoided altogether when investing overseas, but it can be mitigated considerably through the use of hedging techniques.

This is the process of buying or selling currency pairs to offset current positions. Why hedge foreign exchange exposure? How do you mitigate foreign exchange risk?

With some research and careful planning, you can minimise your exposure to foreign exchange risk even if you cannot. The easiest solution is to. How to minimize foreign currency risk invest in countries with strong currencies.

Forward contracts with a forward contract, you enter into. Plan ahead, and have an approximate budget for each currency: Otherwise, it must attempt to.

/GettyImages-157380238-de8368377d114242af29d2d670382aa6.jpg)