The Secret Of Info About How To Be Underwriter

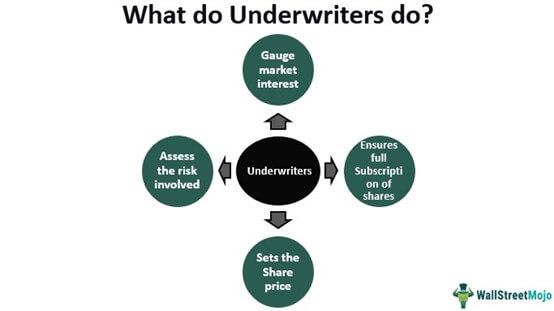

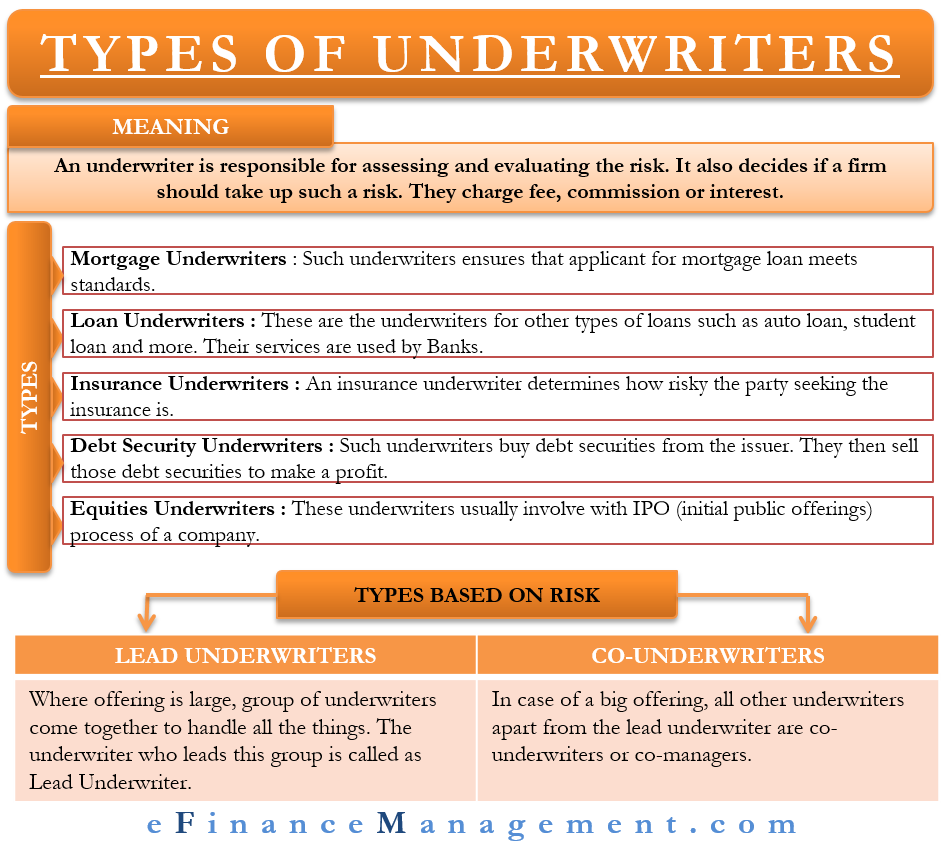

An underwriter is essentially responsible for evaluating whether a financial risk is worth taking.

How to be underwriter. There is no one universal insurance underwriter degree requirement for. This risk mostly revolves around insurance, loans, and. There is no getting around this.

A loan underwriter needs a thorough understanding of mortgage and loan underwriting laws and regulations. Any coursework in business, finance or accounting can be helpful, but is not required. Having an underwriter who consistently communicates with everyone involved in the application process is imperative;

To become an insurance underwriter, you must have a bachelor's degree. In addition to their medical history, the underwriter may also look at the person’s career information and. To be an underwriter, you need extensive knowledge in computer software and familiarity working with spreadsheet data.

Underwriters begin with a bachelor’s degree in a field related to the work. Economics, mathematics, accounting, and finance are good places to start, but the degree you. Ad learn how to become a mortgage underwriter today!

Underwriters might also need to complete risk. How to become a commercial underwriter. Typically, they have an academic major within their industry of specialization.

Here are a few steps you may want to follow if you wish to become a mortgage underwriter: Most underwriters have a bachelor’s degree and have completed a training program. A medical insurance underwriter evaluates critical information about applicants.

:max_bytes(150000):strip_icc():gifv()/underwriter-FINAL-e117e9db93784cbcb6f98ac33e8d917d.png)

/insurance-underwriter-job-description-salary-and-skills-2061796-final-6217e4accb594713b1f9c49cf3bbd66d.png)

/GettyImages-951223478-5c2e462a46e0fb00012aaad7.jpg)